The home buying process involves several key steps: getting pre-approved for a mortgage, finding a home, making an offer, and closing the deal. Each step requires careful planning and consideration to ensure a smooth transaction.

Buying a home is one of the most significant financial decisions you’ll make. Understanding the step-by-step process can help you navigate the complexities with confidence. The journey starts with getting pre-approved for a mortgage, which sets your budget. Next, you’ll search for a home that meets your needs.

Once you find it, you’ll make an offer and negotiate terms. The final step is closing the deal, where you’ll sign the necessary paperwork and officially become a homeowner. This comprehensive approach ensures you’re well-prepared for each stage of the home buying process.

Introduction To Home Buying

Buying a home is a big life event. It can be exciting and scary. This guide will help you understand each step of the home buying process.

From start to finish, knowing what to expect makes it easier. Let’s dive into the details and make your journey smooth.

Why Buy A Home?

Owning a home has many benefits. It provides stability and a place to call your own. You can build equity over time, which is a smart investment.

Homeownership also allows you to customize your living space. You have control over your environment and can make it truly yours.

There are financial advantages too. Homeowners may get tax benefits and potential appreciation in property value.

The Journey Ahead

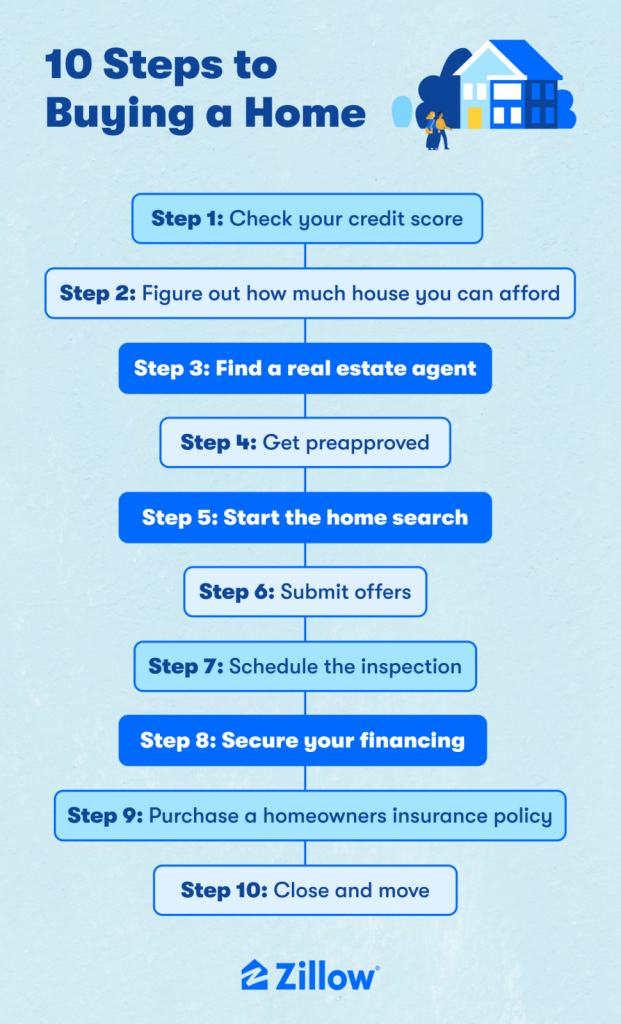

The home buying process has several steps. Each step is important and requires attention. Here is a quick overview:

| Step | Description |

|---|---|

| 1. Prepare Finances | Check your credit score and save for a down payment. |

| 2. Get Pre-Approved | Get a pre-approval letter from a lender. |

| 3. Find a Real Estate Agent | Choose a trusted agent to help you find a home. |

| 4. Start House Hunting | Look at homes and attend open houses. |

| 5. Make an Offer | Submit an offer on the home you like. |

| 6. Home Inspection | Get the home inspected for any issues. |

| 7. Closing | Sign papers and get the keys to your new home. |

Initial Considerations

Buying a home is a big decision. It is essential to plan well. Understanding the initial considerations will help you start the process smoothly.

Budgeting For Your Home

Setting a budget is the first step. Knowing how much you can afford is crucial. Consider your savings, income, and monthly expenses. Remember to include costs like property taxes, insurance, and maintenance.

- Calculate your total savings.

- Check your credit score.

- Determine your monthly income.

- List all monthly expenses.

- Estimate additional costs.

Use a mortgage calculator to get an estimate. This helps in understanding your financial limits.

Choosing The Right Location

The location of your home is very important. It affects your lifestyle and future resale value. Think about your daily commute, local amenities, and school districts.

| Factor | Considerations |

|---|---|

| Commute | Proximity to work and public transport |

| Amenities | Nearby shopping, parks, and medical facilities |

| Schools | Quality of local schools and educational facilities |

| Safety | Crime rates and neighborhood safety |

Visit potential neighborhoods at different times of the day. This gives you a real feel of the area.

- Research online about the neighborhood.

- Talk to current residents.

- Consider future development plans.

Choosing the right location ensures a happy living environment. It also secures a good investment for the future.

Getting Pre-approved For A Mortgage

The home buying process can seem overwhelming. Getting pre-approved for a mortgage is a crucial first step. It helps you understand your budget and shows sellers you are serious.

Why Pre-approval Matters

Pre-approval gives you a clear idea of your price range. It makes your offer more attractive to sellers. Pre-approval can speed up the buying process.

It also helps you identify any credit issues early on. This allows you to address them before you find a home buying.

Documents Needed For Pre-approval

To get pre-approved, you need to gather several documents. These documents help lenders understand your financial situation.

| Document | Details |

|---|---|

| Proof of Income | Pay stubs, tax returns, W-2 forms |

| Proof of Assets | Bank statements, investment account statements |

| Credit History | Credit report, credit score |

| Identification | Driver’s license, Social Security number |

| Employment Verification | Contact information for your employer |

Gather these documents before you apply for pre-approval. This will make the process smoother and faster.

Credit: www.zillow.com

House Hunting

House hunting is an exciting phase in the home buying process. This is where you get to explore different homes and envision your future. To make this step successful, it’s important to be organized and clear about your needs.

Creating A Wishlist

Start by creating a wish list of what you want in a home. Write down the features you need and want. This list will guide your house hunting efforts.

- Location: Do you prefer city or suburban life?

- Size: How many bedrooms and bathrooms do you need?

- Amenities: Do you need a garage, garden, or swimming pool?

- Budget: What is your maximum price range?

- Style: Do you like modern, traditional, or another style?

Having a clear wish list helps you stay focused. It ensures you don’t waste time on unsuitable properties.

Working With A Real Estate Agent

A real estate agent can be a valuable ally during house hunting. They know the market and can help you find home buying that match your wish list.

- Expert Advice: Agents offer insights on neighborhoods and market trends.

- Access to Listings: Agents have access to more property listings.

- Schedule Viewings: They arrange home viewings for you.

- Negotiation: Agents help you negotiate the best price.

Choose an agent who understands your needs. Communicate your wish list clearly to them.

Below is a table summarizing the benefits of working with a real estate agent:

| Benefit | Description |

|---|---|

| Expert Advice | Insights on neighborhoods and market trends |

| Access to Listings | More property listings |

| Schedule Viewings | Arrange home viewings |

| Negotiation | Help negotiate the best price |

By following these steps, you can make the house hunting process smoother and more enjoyable. Happy hunting!

Making An Offer And Negotiations

Making an offer on a house and negotiating the terms can be exciting. This step determines if you get the home of your dreams. You need to understand the offer process and be ready to negotiate terms.

Understanding The Offer Process

Making an offer involves several key steps. First, you need to determine the price you want to offer. Look at the market value of similar homes buying in the area. Your real estate agent can help with this.

Next, you’ll write an offer letter. This letter includes the purchase price, any contingencies, and the closing date. Contingencies are conditions that must be met for the deal to go through. Common contingencies include a satisfactory home buying inspection and securing financing.

Once your offer is ready, your agent will submit it to the seller. The seller can accept, reject, or counter your offer. A counteroffer means the seller wants to negotiate the terms.

Negotiating Terms

If the seller sends a counteroffer, you will enter negotiations. Negotiating can involve several aspects:

- Price: You may need to raise or lower your offer.

- Closing Costs: Decide who pays for which fees.

- Repairs: The seller may agree to fix certain issues.

- Closing Date: Agree on a date that works for both parties.

Effective negotiation requires clear communication and flexibility. Be prepared to compromise on some terms to get the home buying you want.

| Term | Negotiation Point |

|---|---|

| Price | Offer a fair price based on market analysis. |

| Closing Costs | Decide how to split these costs. |

| Repairs | Negotiate which repairs the seller will handle. |

| Closing Date | Agree on a date that suits both sides. |

Once you and the seller agree on terms, the offer becomes a binding contract. You will then move on to the next steps in the home buying process.

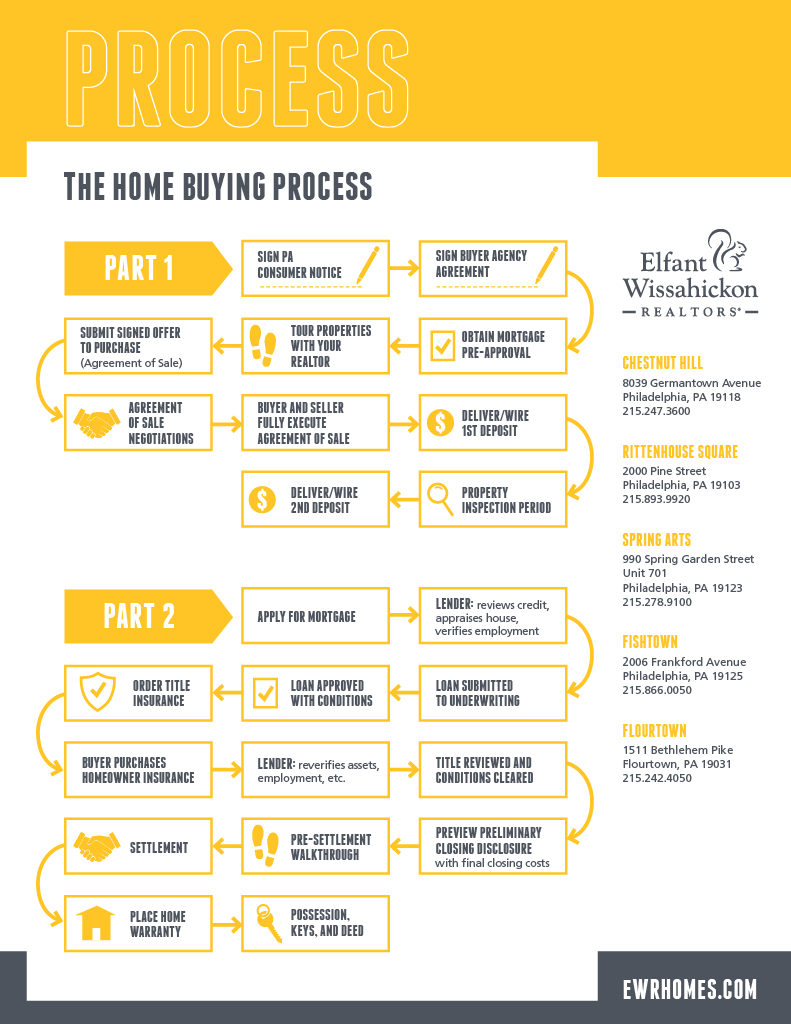

Credit: elfantwissahickon.com

Closing The Deal

The final step in the home buying process is closing the deal. This phase requires careful attention to detail. Let’s walk through the key steps involved.

Final Home Inspection

Before you close, conduct a final home inspection. This ensures the home buying is in the agreed condition. Here’s what to look for:

- Check for any new damages.

- Ensure all repairs are complete.

- Verify that appliances work.

- Test plumbing and electrical systems.

If issues arise, negotiate with the seller for repairs or credits. This step ensures your new home meets expectations.

The Closing Process

The closing process involves multiple steps. It’s essential to understand each part:

- Review the Closing Disclosure form. This details your loan terms and closing costs.

- Perform a final walk-through of the property. Ensure it’s in the agreed condition.

- Sign the required documents. This includes the mortgage note and deed of trust.

- Pay the closing costs. These may include fees for inspections, appraisals, and title insurance.

- Receive the keys to your new home. Congratulations, you are now a homeowner!

Below is a table summarizing the key steps in the closing process:

| Step | Description |

|---|---|

| Review Closing Disclosure | Check loan terms and closing costs |

| Final Walk-Through | Inspect the property one last time |

| Sign Documents | Complete the necessary paperwork |

| Pay Closing Costs | Settle fees for services and insurance |

| Receive Keys | Get access to your new home |

Understanding these steps will help you smoothly navigate the closing process. Your dream home is just a few steps away!

Credit: proteammn.com

Frequently Asked Questions

What Is The First Step In Home Buying?

The first step is getting pre-approved for a mortgage.

How Long Does The Home Buying Process Take?

It typically takes 30 to 60 days to complete.

What Documents Are Needed For A Mortgage?

You’ll need tax returns, pay stubs, bank statements, and ID.

How Do I Find The Right Home?

Work with a real estate agent and research neighborhoods.

What Is A Home Inspection?

A home inspection evaluates the property’s condition before purchase.

When Do I Make An Offer?

Make an offer after finding a home you love.

Conclusion

Navigating the home buying process can seem daunting, but following these steps makes it manageable. From pre-approval to closing, each step is crucial. Understanding the process ensures a smoother experience. Stay informed, work with professionals, and soon you’ll have the keys to your new home.

Happy house hunting!