Selling a home typically costs between 6% to 10% of the sale price. Costs include agent commissions, repairs, and closing fees.

Selling a home involves various expenses that sellers need to consider. Real estate agent commissions usually take up the largest portion, often around 5% to 6% of the sale price. Additionally, sellers might need to invest in home repairs and staging to attract buyers.

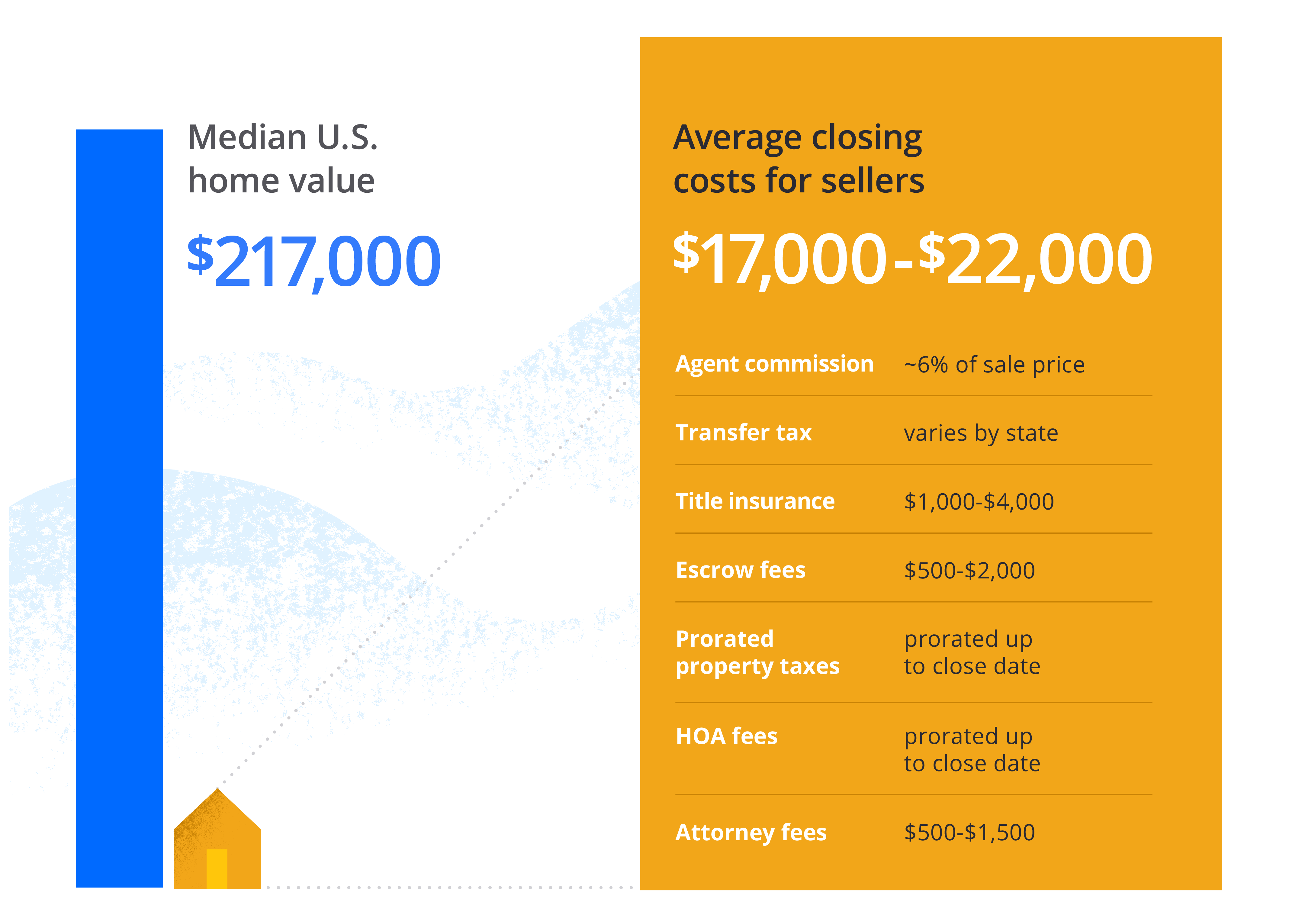

Closing costs, including title insurance, escrow fees, and transfer taxes, also add to the total expense. Marketing costs, such as professional photography and online listings, may further increase the overall cost. By understanding these expenses, sellers can better prepare for the financial aspects of selling a home and maximize their profit.

Credit: www.zillow.com

Introduction To Home Selling Costs

Selling a home can be expensive. Many factors affect the total cost. Understanding these costs helps you plan better. Knowing what to expect reduces stress. Let’s explore the costs of selling a home.

Factors Influencing Selling Costs

- Real Estate Agent Fees: Agents charge a commission. This is usually 5-6% of the sale price.

- Home Repairs: Fixing issues before selling can be costly. Buyers prefer homes in good condition.

- Staging Costs: Staging makes your home look nice. This attracts more buyers.

- Closing Costs: These are fees paid at the end of the sale. They include title insurance and transfer taxes.

- Marketing Costs: Advertising your home can add up. This includes online listings and open houses.

Average Costs Across The U.S.

| Expense Type | Average Cost |

|---|---|

| Real Estate Agent Fees | $12,000 – $18,000 (based on a $300,000 home) |

| Home Repairs | $2,000 – $5,000 |

| Staging Costs | $1,000 – $3,000 |

| Closing Costs | $3,000 – $7,000 |

| Marketing Costs | $500 – $2,000 |

Real Estate Agent Commissions

Understanding Real Estate Agent Commissions is crucial when selling your home. These fees are typically the largest expense. They can significantly impact your net profit. Knowing how these commissions work helps you budget better. Let’s dive into the details.

Calculating Commission Fees

Real estate agents usually charge a percentage of the sale price. The standard rate is often 5% to 6%. For instance, selling a $300,000 home at 6% commission costs $18,000. This fee is split between the seller’s and buyer’s agents.

Here is a simple breakdown:

| Home Sale Price | Commission Rate | Total Commission |

|---|---|---|

| $300,000 | 6% | $18,000 |

| $500,000 | 6% | $30,000 |

| $700,000 | 6% | $42,000 |

Negotiating Lower Rates

You can try negotiating lower commission rates. Some agents may agree to a 4% or 5% rate. This can save you thousands of dollars. Here are some tips:

- Compare different agents and their rates.

- Highlight your home’s marketability and quick sale potential.

- Ask for a sliding scale commission structure.

Negotiating can be easier if the home is in a high-demand area. Always ask for any discounts or special offers. Some agents offer reduced rates for repeat customers.

Remember, a lower commission does not always mean lower service quality. Look for experienced agents who offer competitive rates.

Home Preparation And Staging

Selling a home involves several costs, and home preparation and staging are critical components. These steps ensure your home looks its best, attracting potential buyers and maximizing your sale price. But how much will it cost you? Let’s break down the expenses involved in preparing and staging your home.

Repair And Renovation Expenses

Before staging, you may need to tackle necessary repairs and renovations. These fixes help improve your home’s overall appearance and functionality.

- Minor Repairs: Small fixes like patching holes, fixing leaks, or replacing broken tiles. These usually cost between $100 and $500.

- Major Repairs: Larger projects like roof repairs, plumbing, or electrical issues. These can range from $1,000 to $10,000 or more.

- Renovations: Updating kitchens, bathrooms, or floors can significantly boost your home’s value. These projects can cost between $5,000 and $50,000.

It’s essential to budget for these expenses to avoid unexpected costs. Consult with contractors for accurate estimates.

Costs Of Staging Your Home

Staging involves setting up your home to appeal to buyers. This can include furniture rental, decor, and professional staging services.

| Staging Service | Average Cost |

|---|---|

| Initial Consultation | $200 – $400 |

| Furniture Rental | $500 – $2,000 per month |

| Professional Staging Service | $1,000 – $5,000 |

| Photography | $200 – $500 |

Staging your home can make a significant difference in buyer perception. Well-staged homes often sell faster and at higher prices.

Keep these home preparation and staging costs in mind. Proper budgeting ensures a smoother selling process and better returns on your investment.

Credit: www.ramseysolutions.com

Closing Costs For Sellers

Selling a home involves various costs. These are known as closing costs. These costs can impact your final profit. Let’s break down the most common closing costs for sellers.

Title Insurance Fees

Title insurance protects the buyer from title issues. It ensures the title is clear of liens. Sellers often pay for this insurance. The cost varies but usually ranges from $500 to $1,000.

Transfer Taxes And Attorney Fees

Transfer taxes are fees to transfer the property title. They are usually a percentage of the sale price. These fees can range from 0.1% to 2% of the home’s value.

Attorney fees cover legal services for the sale. These services include preparing documents and closing the deal. Attorney fees range from $500 to $1,500.

| Cost Type | Estimated Amount |

|---|---|

| Title Insurance Fees | $500 – $1,000 |

| Transfer Taxes | 0.1% – 2% of sale price |

| Attorney Fees | $500 – $1,500 |

Marketing Your Home

Effective marketing is crucial to sell a home quickly and at a good price. By investing in professional services and online listings, you can attract more potential buyers. Below, we break down key marketing costs involved in selling your home.

Professional Photography

High-quality photos make your home stand out. Hiring a professional photographer can cost between $100 and $500. These photos highlight the best features of your home. Potential buyers often make decisions based on photos. Good lighting and angles can showcase your home’s beauty.

Online Listing Fees

Listing your home online is essential. Many potential buyers search for homes on the internet. Fees for online listings vary. Some websites offer free listings, while others charge a fee. A popular real estate website might charge $50 to $200 for a premium listing. These listings often include more photos and a higher placement on the site.

Consider the following table to understand the costs better:

| Service | Cost Range |

|---|---|

| Professional Photography | $100 – $500 |

| Online Listing Fees | $50 – $200 |

By investing in these marketing strategies, you can increase your home’s visibility. This can lead to a faster sale at a better price.

Credit: theasateam.com

Hidden Costs Of Selling

Selling a home is exciting but comes with hidden costs. These costs often surprise many sellers. Knowing these can help you prepare better.

Home Inspection Remedies

Before selling, a home inspection is crucial. Inspectors may find issues needing fixes. These repairs can be costly. Common problems include:

- Roof leaks

- Plumbing issues

- Electrical problems

- Foundation cracks

Fixing these is often necessary. Buyers demand a move-in-ready home. Ignoring repairs can lead to lower offers. You might need to hire professionals. This adds to your expenses. Budgeting for these repairs is wise.

Unexpected Delays And Issues

Unexpected delays can occur. These delays can arise from various issues. Examples include:

- Buyer’s financing problems

- Title issues

- Appraisal discrepancies

- Weather-related delays

Such delays can extend the selling process. This can increase your holding costs. Holding costs include:

| Type | Cost |

|---|---|

| Mortgage payments | $1,000 – $2,000/month |

| Utilities | $100 – $300/month |

| Property taxes | $200 – $500/month |

| Insurance | $50 – $150/month |

These costs add up quickly. Being aware of these potential issues helps. You can plan and budget accordingly.

Frequently Asked Questions

How Much Are Closing Costs For Sellers?

Closing costs for sellers typically range from 6% to 10% of the home’s sale price.

What Are Real Estate Agent Fees?

Real estate agent fees usually amount to 5% to 6% of the home’s sale price, split between buyer and seller agents.

Do I Need To Pay For Home Staging?

Home staging costs vary but generally range from $500 to $2,000 depending on the size of your home.

Are There Any Hidden Fees In Selling A Home?

Possible hidden fees include repairs, staging, and attorney fees. Always review contracts carefully to avoid surprises.

What Is The Cost Of A Home Inspection?

A home inspection typically costs between $300 and $500, depending on the location and size of the property.

Is It Expensive To Get A Home Appraisal?

A home appraisal usually costs between $300 and $600. This provides an unbiased estimate of your home’s market value.

Conclusion

Selling a home involves various costs, including agent fees, repairs, and closing costs. Understanding these expenses helps you plan better. Proper budgeting ensures you maximize your profit. Always consult with professionals for accurate estimates. Knowing the costs upfront can make your home-selling process smoother and more profitable.