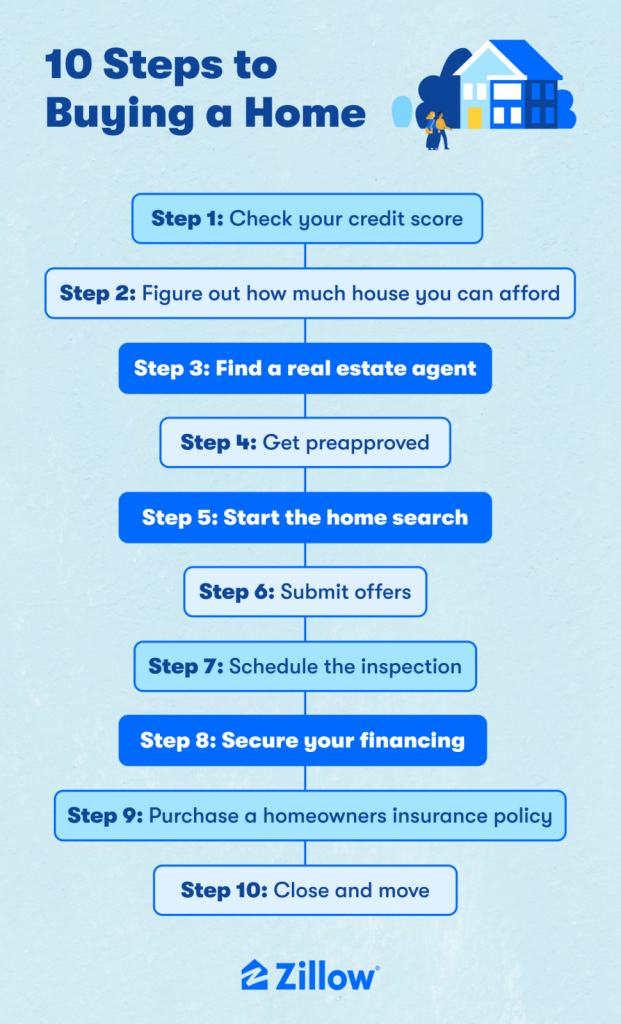

Steps to buying a house for the first time include determining your budget and getting pre-approved for a mortgage. Next, find a real estate agent and start house hunting.

Buying a house for the first time can be both exciting and daunting. It’s important to understand the steps involved to make informed decisions. Begin by assessing your financial situation and setting a realistic budget. Getting pre-approved for a mortgage will give you a clear idea of how much you can afford.

With your budget in mind, engage a reliable real estate agent who can guide you through the process. Start exploring neighborhoods and properties that fit your criteria. Being well-prepared can make the journey to homeownership smoother and more enjoyable.

Starting Your Home Buying Journey

Buying a house is a big step. It’s exciting but requires planning. For first-time buyers, this journey can feel overwhelming. Follow these steps to ease the process.

Evaluating Your Budget

Knowing your budget is crucial. Start by reviewing your finances. Check your savings and monthly income.

Here’s a simple table to help you:

| Financial Aspect | Amount |

|---|---|

| Monthly Income | $XXXX |

| Monthly Expenses | $XXXX |

| Savings | $XXXX |

Subtract your monthly expenses from your monthly income. This gives you an idea of what you can afford. Also, ensure you have enough savings for a down payment.

- Check your credit score.

- Calculate your debt-to-income ratio.

These steps will help determine your budget for a new home.

Understanding Your Needs Vs. Wants

List your needs and wants. Needs are essential; wants are nice to have.

- Make two columns on a sheet of paper.

- Label one column “Needs” and the other “Wants”.

- Write down what you must have in a home under “Needs”.

- Write down nice-to-have features under “Wants”.

Here’s an example:

| Needs | Wants |

|---|---|

| 3 Bedrooms | Pool |

| 2 Bathrooms | Big Yard |

| Good Schools | Close to Work |

Understanding this helps you focus on homes that meet your needs first. It prevents wasting time on homes that don’t fit your budget or lifestyle.

Credit: www.tsahc.org

Getting Financially Prepared

Buying a house for the first time is exciting. It’s also a big financial step. Before you start looking at homes, it’s important to get your finances in order. This means understanding what you can afford and securing financing. Below, we discuss two key steps: securing a mortgage pre-approval and exploring financing options.

Securing A Mortgage Pre-approval

Before shopping for a home, get pre-approved for a mortgage. This shows sellers you are serious. It also helps you understand your budget.

To get pre-approved, you will need:

- Proof of income

- Credit history

- Employment verification

- Personal identification

The lender will review your financial situation. If everything looks good, you’ll get a pre-approval letter. This letter states how much you can borrow. It can make your offer more attractive to sellers.

Exploring Financing Options

There are different ways to finance your home purchase. It’s important to explore these options and choose the one that fits your needs best.

Here are some common financing options:

| Option | Description |

|---|---|

| Conventional Loan | Not insured by the government. Requires good credit. |

| FHA Loan | Insured by the Federal Housing Administration. Easier to qualify for. |

| VA Loan | Available to veterans. Often requires no down payment. |

| USDA Loan | For rural properties. May offer low interest rates. |

Each option has its pros and cons. Speak with a mortgage advisor to understand which one suits you best. Make sure to compare interest rates and terms.

Getting financially prepared is the first step to buying a home. It sets the foundation for a smooth purchasing process.

Finding The Right Location

Choosing the perfect location is key when buying a house for the first time. The right neighborhood can significantly impact your daily life and long-term investment. This section will guide you through the essential steps to find the ideal location for your new home.

Researching Neighborhoods

Start by researching neighborhoods that catch your interest. Look for areas with good schools, low crime rates, and convenient amenities. Use online tools to gather information about different locations. Join local forums and social media groups to get insights from residents. Visit neighborhoods at different times of the day to get a feel for the area.

- Check school ratings

- Review crime statistics

- Explore local amenities

- Engage with local communities online

- Visit at various times

Considering Long-term Value

Think about the long-term value of your chosen location. Consider future developments and infrastructure projects. Look for areas with potential growth and appreciation. Research property value trends in the neighborhood. Choose a location that aligns with your future plans and financial goals.

| Factors | Considerations |

|---|---|

| Future Developments | Planned projects and infrastructure |

| Growth Potential | Economic and population growth |

| Property Value Trends | Historical and projected trends |

| Alignment with Plans | Personal and financial goals |

Choosing the right location requires careful consideration and research. Prioritize what matters most to you and your family. By doing thorough research, you can find a location that meets your needs and offers long-term value.

Credit: www.zillow.com

The House Hunt

The house hunt is an exciting step in buying your first home. It involves exploring different neighborhoods, visiting various properties, and envisioning your future lifestyle. This phase requires patience, research, and a keen eye for detail. Let’s dive into the critical aspects of the house hunt.

Scheduling Viewings

Scheduling viewings is a crucial part of finding the right home. Start by making a list of properties that interest you. Contact real estate agents to set up appointments. It’s essential to visit homes during different times of the day. This helps you understand the neighborhood’s vibe and noise levels.

Keep track of each viewing using a spreadsheet. Include columns for the property’s address, viewing date, and your thoughts. Here’s a simple table to get you started:

| Address | Viewing Date | Comments |

|---|---|---|

| 123 Maple Street | 01/05/2023 | Spacious, needs renovation |

| 456 Oak Avenue | 01/06/2023 | Modern, great neighborhood |

Assessing Property Potential

Assessing property potential is key to making a sound investment. During each viewing, pay attention to the home’s condition. Look for signs of damage or needed repairs. Check the roof, walls, and foundation. These areas can indicate costly future repairs.

Consider the layout and size of the rooms. Think about your lifestyle and if the space meets your needs. Here are some questions to ask yourself:

- Does the home have enough bedrooms and bathrooms?

- Is there sufficient storage space?

- Are the kitchen and living areas adequate for entertaining?

Also, evaluate the property’s location. Check the proximity to schools, workplaces, and essential services. A good location can significantly impact your daily life and the property’s resale value.

Taking detailed notes and photos during viewings can help you compare properties later. This organized approach ensures you make an informed decision.

Making An Offer

Buying a house for the first time is exciting. Once you find the perfect home, the next step is making an offer. This process can seem complex, but with the right knowledge, you can navigate it confidently.

Negotiating Terms

Before making an offer, decide on the price. Look at recent sales in the area. Compare those homes to the one you want.

- Start with a fair offer.

- Be prepared to negotiate.

- Stay within your budget.

Communicate clearly with the seller. Use your real estate agent to help with negotiations.

Understanding Contingencies

Contingencies protect you during the buying process. They are conditions that must be met for the sale to go through.

| Type of Contingency | Description |

|---|---|

| Inspection | The home must pass a professional inspection. |

| Financing | You must secure a mortgage. |

| Appraisal | The home must appraise for the loan amount. |

Include these contingencies in your offer to protect yourself. Review each one carefully with your agent.

Closing The Deal

Closing the deal is the final step in buying your first home. It involves signing contracts and finalizing payments. This step can be thrilling and nerve-wracking. Here’s what you need to know to close the deal smoothly.

Finalizing The Sale

The sale finalizes with a few key steps. First, you review all documents. Ensure all information is correct. Next, sign the necessary paperwork. Both parties must sign.

Then, you make the final payment. This includes the down payment and closing costs. Use a cashier’s check or wire transfer. Your lender will guide you through this.

Lastly, you receive the keys to your new home. Congratulations! The house is now yours.

Preparing For Move-in

Preparation for move-in is crucial. Create a checklist to stay organized. Here’s a sample checklist:

- Change the locks for security.

- Set up utilities like water, gas, and electricity.

- Inspect the house for any immediate repairs.

- Notify your address change to important contacts.

Also, plan your moving day. Hire a moving company or rent a truck. Pack your belongings in advance. Label boxes by room for easy unpacking.

Ensure your new home is ready for you and your family. Clean the house before moving in. Set up essential furniture first. This makes the transition smoother.

| Task | Details |

|---|---|

| Change Locks | Ensure only you have access |

| Set Up Utilities | Water, gas, electricity, and internet |

| Inspect House | Check for repairs or issues |

| Notify Address Change | Inform banks, employers, and others |

These steps ensure a smooth move-in experience. Enjoy your new home!

Credit: www.nar.realtor

Frequently Asked Questions

What Are The Steps To Buy A House?

Understand your budget, get pre-approved, find a real estate agent, search for homes, make an offer, and close the deal.

How Do I Get Pre-approved For A Mortgage?

Contact a lender, submit financial documents, and they will evaluate your credit score and income to determine your loan eligibility.

What Should I Consider When Choosing A Real Estate Agent?

Look for experience, local market knowledge, good reviews, and strong communication skills to ensure they meet your needs.

How Do I Make A Competitive Offer?

Research comparable home prices, understand the market, and work with your real estate agent to craft a strong, appealing offer.

What Is The Home Inspection Process?

A professional inspector examines the property for issues. You’ll receive a report detailing any problems that need attention.

How Do I Close On A House?

Review all closing documents, sign necessary paperwork, pay closing costs, and receive the keys to your new home.

Conclusion

Taking the right steps can make buying your first house smoother. Research, plan, and stay informed. Trust your instincts and seek professional advice. With patience and preparation, homeownership is within reach. Enjoy the journey and soon you’ll have the keys to your dream home.

Happy house hunting!