A commercial real estate business plan outlines strategies for acquiring, managing, and profiting from commercial properties. It includes market analysis, financial projections, and marketing plans.

A solid business plan is essential for success in commercial real estate. It serves as a roadmap, guiding decisions and strategies. Market analysis identifies opportunities and competition. Financial projections provide a clear picture of potential revenue and expenses. Marketing plans detail how to attract tenants or buyers.

A well-crafted plan helps secure funding and ensures that all aspects of the business are covered. With a clear, concise, and actionable plan, commercial real estate ventures can navigate challenges and capitalize on opportunities, leading to sustained growth and profitability.

Credit: fitsmallbusiness.com

Introduction To Commercial Real Estate Investing

Commercial real estate investing involves buying properties for business purposes. These properties include office buildings, retail spaces, warehouses, and more. The goal is to generate income or profit from these investments. Understanding market trends and potential returns is crucial for success.

Market Trends

Market trends in commercial real estate are ever-changing. Keeping an eye on these trends can help you make smart investment decisions.

- Urbanization: More people are moving to cities. This increases demand for office and retail spaces.

- Technology: Tech advancements are changing how businesses operate. This impacts the type of spaces in demand.

- Economic Cycles: The economy affects real estate prices. During a boom, prices rise. During a recession, prices fall.

- Environmental Concerns: Sustainable buildings are becoming more popular. Investors are looking for eco-friendly options.

Potential Returns

Commercial real estate offers various potential returns. These returns can be from rental income or property appreciation.

| Type | Description |

|---|---|

| Rental Income | Money earned from leasing the property to tenants. |

| Property Appreciation | Increase in property value over time. |

| Tax Benefits | Various tax deductions and credits available. |

Many investors find these returns appealing. They provide a steady income and potential for growth.

Credit: www.slideteam.net

Crafting Your Business Plan

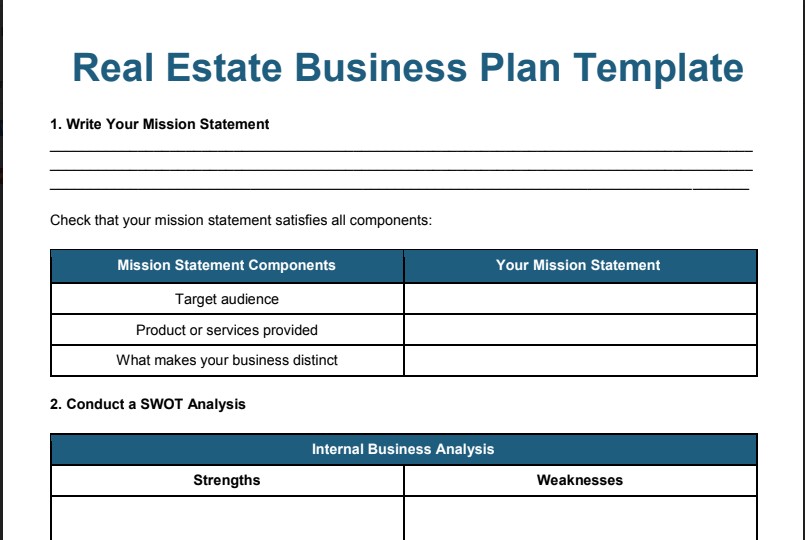

Creating a commercial real estate business plan is vital for success. It helps guide your path and keeps you focused. This plan outlines your goals, projects finances, and sets your strategy. Let’s explore the crucial components of crafting your business plan.

Goals And Objectives

Define your goals and objectives clearly. These should be specific, measurable, achievable, relevant, and time-bound (SMART). Here are some key points to consider:

- Short-term goals: Leasing a certain number of properties within a year.

- Long-term goals: Expanding to new markets within five years.

- Objectives: Increasing brand awareness and client satisfaction.

Write down your goals and review them regularly. This helps you stay on track and measure progress.

Financial Projections

Creating financial projections is essential. It shows potential investors your business’s financial health. Here are key elements to include:

| Element | Description |

|---|---|

| Revenue Projections | Estimate your income from property sales or leases. |

| Expense Projections | List all costs, including maintenance and staffing. |

| Profit and Loss Statement | Show expected profits after expenses. |

| Cash Flow Statement | Track the flow of cash in and out of your business. |

| Break-even Analysis | Determine when your business will start making a profit. |

Ensure your financial projections are realistic. This builds trust with investors and stakeholders. Use conservative estimates to avoid over-promising.

Analyzing The Market

Understanding the market is key for a successful commercial real estate business plan. Analyzing the market involves studying demographics and competitors. This helps in making informed decisions.

Demographic Studies

Demographic studies reveal important information about the population. Knowing the age, income, and education levels helps. This data helps tailor your services to potential clients.

Here is a table showing the importance of demographic factors:

| Factor | Importance |

|---|---|

| Age | Identify target market segments. |

| Income | Determine purchasing power. |

| Education | Assess professional needs. |

Competitor Analysis

Competitor analysis helps understand what others in the market are doing. This includes their strengths and weaknesses.

Steps for conducting a competitor analysis:

- Identify your main competitors.

- Analyze their business strategies.

- Evaluate their customer base.

- Assess their marketing tactics.

Competitor analysis helps in finding gaps in the market. It also helps in identifying opportunities for improvement.

Investment Strategies

Commercial real estate investment strategies are key to success. Investors must choose between various strategies. This section discusses two main strategies: Direct Ownership and Real Estate Investment Trusts (REITs).

Direct Ownership

Direct ownership involves buying properties outright. Investors have full control and responsibility. They manage and maintain the property. This strategy requires significant capital and expertise.

Benefits of direct ownership include:

- Full control over property decisions

- Potential for higher returns

- Ability to leverage the property

Challenges include:

- High initial investment

- Ongoing maintenance costs

- Need for property management skills

Real Estate Investment Trusts (reits)

REITs allow investors to pool funds. They invest in a diversified portfolio of properties. This strategy offers passive income and liquidity.

Benefits of REITs include:

- Lower entry cost compared to direct ownership

- Diversification of investments

- Regular dividends

Challenges include:

- Less control over specific properties

- Market risk

- Fees and expenses

Both strategies have pros and cons. Choose based on your goals and resources.

Risk Management

Effective risk management is vital for a successful commercial real estate business plan. It helps minimize potential losses and ensures business continuity. Here, we explore key strategies for managing risks in commercial real estate.

Insurance Coverage

Insurance coverage is crucial for protecting your investment. It safeguards against unforeseen events. Consider the following types of insurance:

- Property Insurance: Covers damages to buildings and structures.

- Liability Insurance: Protects against legal claims from third parties.

- Business Interruption Insurance: Compensates for lost income during disruptions.

Having the right insurance coverage reduces financial risks. It ensures your business can recover quickly from setbacks.

Diversification Strategies

Diversification strategies help spread risk across different investments. This approach minimizes the impact of any single loss. Consider these diversification methods:

- Geographic Diversification: Invest in properties in different locations.

- Sector Diversification: Diversify across various commercial sectors like office, retail, and industrial.

- Tenant Diversification: Lease to multiple tenants from different industries.

By diversifying, you reduce dependency on any single market or tenant. This strategy helps stabilize your income and protects against market fluctuations.

| Risk Management Strategy | Benefit |

|---|---|

| Insurance Coverage | Protects against financial losses from unforeseen events. |

| Diversification Strategies | Minimizes impact of single investment losses. |

Marketing Your Properties

Marketing is crucial for success in the commercial real estate business. Effective marketing helps attract potential tenants or buyers. It ensures your properties get the attention they deserve. Below are two key strategies to market your properties effectively.

Digital Marketing

Digital marketing is essential in today’s real estate market. Here are some strategies to consider:

- Social Media: Use platforms like Facebook, LinkedIn, and Instagram.

- Website: Create an SEO-optimized website with property listings.

- Email Campaigns: Send newsletters to your contact list.

- Online Ads: Invest in Google Ads and social media ads.

A well-designed website can showcase your properties. Include high-quality photos and virtual tours. This attracts potential clients and keeps them engaged. Use targeted ads to reach specific demographics. Digital marketing allows you to track performance and adjust strategies.

Networking Events

Networking events offer a great way to market your properties. Attend industry conferences and local meetups. This helps you build relationships with potential clients and partners.

| Event Type | Benefits |

|---|---|

| Industry Conferences | Connect with industry leaders and gain insights. |

| Local Meetups | Build relationships within the community. |

| Property Showcases | Directly present your properties to interested parties. |

Networking events provide face-to-face interaction. This builds trust and credibility. Share business cards and follow up with contacts. Engage in conversations and listen to what others need. This helps you understand market demands and tailor your offers.

Monitoring And Adjusting Your Plan

Regularly monitoring and adjusting your commercial real estate business plan is crucial. This ensures you stay on track and adapt to changes. Reviewing your strategy helps in meeting your goals and overcoming challenges.

Performance Metrics

Tracking performance metrics is essential. It helps you evaluate the effectiveness of your plan. Use key performance indicators (KPIs) to measure success.

- Occupancy rates

- Net operating income (NOI)

- Return on investment (ROI)

- Rent collection rates

Create a table to summarize monthly performance metrics. This helps in quick analysis.

| Month | Occupancy Rate | NOI | ROI | Rent Collection |

|---|---|---|---|---|

| January | 95% | $50,000 | 8% | 98% |

| February | 93% | $48,000 | 7.8% | 97% |

Adapting To Market Changes

The real estate market is dynamic. It’s vital to adapt to market changes.

- Stay updated with market trends.

- Analyze competitor strategies.

- Adjust rental rates based on demand.

Flexibility in your business plan ensures resilience. Make adjustments based on market conditions to maintain profitability.

Credit: fitsmallbusiness.com

Frequently Asked Questions

What Is A Commercial Real Estate Business Plan?

A commercial real estate business plan outlines your goals, strategies, market analysis, and financial projections.

Why Is Market Analysis Important?

Market analysis helps you understand trends, competition, and opportunities in the commercial real estate sector.

How Do You Set Financial Goals?

Set financial goals by estimating costs, projecting revenues, and planning for contingencies.

What Should Be Included In An Executive Summary?

An executive summary includes your business vision, key objectives, market overview, and financial highlights.

How Do You Identify Target Clients?

Identify target clients by researching demographics, business needs, and market demands.

Conclusion

Crafting a solid commercial real estate business plan is crucial for success. Focus on market analysis, financial projections, and strategic goals. Regularly update your plan to adapt to market changes. By doing so, you’ll stay ahead in the competitive real estate market.

A well-thought-out plan can significantly boost your business growth and profitability.