The 5 best real estate investment private companies are Blackstone, Brookfield Asset Management, Starwood Capital, TPG Real Estate, and Colony Capital. Real estate investment offers lucrative opportunities for investors seeking stable returns.

Private companies in this sector manage extensive portfolios, encompassing residential, commercial, and industrial properties. Blackstone stands out with its diverse real estate holdings and significant market influence. Brookfield Asset Management is renowned for its global reach and comprehensive asset management services.

Starwood Capital excels in both equity and debt investments, offering a balanced approach. TPG Real Estate focuses on value-added investments, driving growth through strategic acquisitions. Colony Capital specializes in digital real estate, reflecting the industry’s technological advancements. These companies provide robust investment options, catering to varied investor preferences and goals.

Introduction To Real Estate Investment

Real estate investment is a popular way to build wealth. It involves purchasing properties to generate income or appreciate in value. Many choose to invest in real estate due to its potential for high returns and stability.

Why Choose Private Companies?

Private companies offer tailored investment opportunities. They provide personalized services and expert advice. With private firms, investors often get exclusive deals not available to the public.

| Benefits | Details |

|---|---|

| Personalized Attention | Private firms offer one-on-one guidance to investors. |

| Exclusive Opportunities | Investors can access unique real estate deals. |

| Expert Knowledge | Firms have in-depth market understanding and strategies. |

Benefits Of Real Estate Investment

- Steady Income: Rental properties provide regular income.

- Appreciation: Property values often increase over time.

- Tax Benefits: Investors can enjoy various tax deductions.

- Diversification: Real estate diversifies investment portfolios.

- Inflation Hedge: Property values usually rise with inflation.

Criteria For Selecting Top Picks

Choosing the best real estate investment private companies can be challenging. Investors must consider several factors to ensure they make informed decisions. This section will outline the key criteria to focus on when selecting top picks.

Performance Metrics

Performance metrics are essential when evaluating real estate investment companies. These metrics provide insights into the company’s financial health and growth potential. Some of the most critical performance metrics include:

- Return on Investment (ROI): This metric shows the company’s profitability. A higher ROI indicates better performance.

- Net Operating Income (NOI): NOI measures the company’s income after operating expenses. It helps assess the company’s efficiency.

- Capitalization Rate (Cap Rate): Cap Rate indicates the expected rate of return on a property. A higher Cap Rate suggests a better investment opportunity.

- Occupancy Rate: This metric shows the percentage of occupied properties. A high occupancy rate reflects strong demand.

- Debt-to-Equity Ratio: This ratio measures the company’s financial leverage. A lower ratio indicates less risk.

Market Reputation

Market reputation is another crucial factor in selecting real estate investment companies. A company’s reputation can significantly impact its success and reliability. Key aspects to consider include:

- Customer Reviews: Positive reviews reflect satisfied clients. Look for companies with consistently high ratings.

- Industry Awards: Awards and recognitions indicate industry approval. They highlight the company’s achievements and credibility.

- Partnerships and Collaborations: Strong partnerships show trust and reliability. Collaborations with reputable firms add value.

- Media Coverage: Positive media coverage enhances the company’s public image. It also helps attract potential investors.

- Years in Business: Longevity in the market indicates stability. Companies with a long history are usually more reliable.

Company 1: Pioneers In Innovation

Company 1 stands out as a leader in the real estate sector. They are known for their innovative approaches and cutting-edge solutions. Their focus on technology and modern investments sets them apart.

Investment Opportunities

Company 1 offers a range of investment opportunities that cater to diverse investor needs. Whether you are a seasoned investor or a newcomer, there is something for everyone.

- Residential Properties

- Commercial Real Estate

- Industrial Spaces

- Mixed-Use Developments

They provide detailed analysis and insights for every investment option. This helps investors make informed decisions.

Success Stories

Company 1 has a track record of successful projects and satisfied investors. Here are a few highlights:

| Project Name | Location | ROI |

|---|---|---|

| Green Valley Residences | New York | 15% |

| Tech Park Commercial | San Francisco | 20% |

| Sunrise Industrial Hub | Chicago | 18% |

Investors have praised these projects for their high returns and strategic locations. These success stories demonstrate the company’s ability to deliver on its promises.

Company 2: Sustainable Investing

Company 2 stands out for its commitment to sustainable investing. They focus on projects that promote environmental responsibility and social equity. Investing with them means contributing to a greener future.

Eco-friendly Projects

One of Company 2’s main pillars is eco-friendly projects. They invest in buildings that use renewable energy. These buildings have solar panels and wind turbines. They also use recycled materials for construction.

Company 2 ensures their projects have green spaces. These spaces include parks and gardens. Green spaces improve air quality and provide recreational areas for communities.

Long-term Impact

Company 2 aims for a long-term impact on the environment. They focus on reducing carbon footprints. Their buildings have energy-efficient systems. These systems save energy and reduce costs.

They also promote sustainable living. This includes water-saving fixtures and waste recycling programs. These initiatives ensure a healthier planet for future generations.

| Feature | Description |

|---|---|

| Renewable Energy | Solar panels and wind turbines |

| Recycled Materials | Used in construction |

| Green Spaces | Parks and gardens |

| Energy-efficient Systems | Reduces energy consumption |

| Sustainable Living | Water-saving and recycling programs |

Company 3: High-yield Strategies

Company 3 stands out in the real estate investment world. They offer high-yield strategies for investors. This company ensures excellent returns on investments. They are known for their smart investment choices.

Diverse Portfolio

Company 3 maintains a diverse portfolio. This includes various types of properties. They invest in residential, commercial, and industrial real estate. A balanced portfolio helps reduce risk and maximize returns.

| Property Type | Percentage of Portfolio |

|---|---|

| Residential | 40% |

| Commercial | 35% |

| Industrial | 25% |

Risk Management

Company 3 excels in risk management. They use advanced tools to analyze market trends. This helps them avoid potential pitfalls. Their team of experts constantly monitors investments.

- Regular market analysis

- Experienced risk management team

- Advanced investment tools

Investors feel safe with Company 3. They trust the company’s strategies. Many investors see significant returns.

Credit: www.wallstreetprep.com

Company 4: Technology-driven Solutions

Company 4 stands out in the real estate market. They use modern technology to deliver solutions. Their innovative tools make investing in real estate easy. They focus on improving the investor’s experience.

Cutting-edge Tools

Company 4 uses advanced tools to help investors. These tools make property management simple. Investors can track their investments online. They use data analytics to provide insights. This helps investors make better decisions.

| Tool | Description |

|---|---|

| Data Analytics | Provides insights for better investment decisions. |

| Online Tracking | Allows investors to monitor their properties easily. |

| Mobile App | Gives access to investment updates on the go. |

Enhanced Customer Experience

Company 4 ensures a top-notch experience for their clients. They offer a user-friendly platform. Investors can access information anytime. Their support team is always ready to help. This builds trust and satisfaction among investors.

- User-friendly platform: Easy navigation and access to tools.

- 24/7 Support: Assistance available round the clock.

- Regular updates: Investors get timely notifications.

Company 4’s technology-driven approach sets them apart. They make real estate investment easy and efficient.

Company 5: Global Real Estate Leader

Global Real Estate Leader is a top player in the real estate market. They have a strong presence worldwide. Their innovative approach has set them apart in the industry. They manage properties across various continents.

International Presence

Global Real Estate Leader operates in over 50 countries. They specialize in commercial, residential, and industrial properties. Their portfolio includes:

- Luxury residential complexes

- High-end commercial spaces

- State-of-the-art industrial parks

Their international presence ensures diverse investment opportunities. They have offices in major cities like:

| City | Country |

|---|---|

| New York | USA |

| London | UK |

| Tokyo | Japan |

| Sydney | Australia |

Future Expansion Plans

Global Real Estate Leader has ambitious expansion plans. They aim to enter emerging markets. Their strategy includes:

- Investing in smart cities

- Developing eco-friendly buildings

- Enhancing digital platforms for better customer service

Their future plans also focus on technology. They use AI to predict market trends. This helps in making informed decisions.

Global Real Estate Leader is committed to sustainable growth. They aim to reduce carbon footprints. They also plan to invest in renewable energy projects.

:max_bytes(150000):strip_icc()/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)

Credit: www.investopedia.com

Credit: time.com

Frequently Asked Questions

What Are The Top Real Estate Investment Companies?

The top real estate investment companies offer high returns, excellent customer service, and transparent operations.

Why Invest In Private Real Estate Firms?

Private real estate firms provide tailored investment strategies, higher returns, and diversification options compared to public markets.

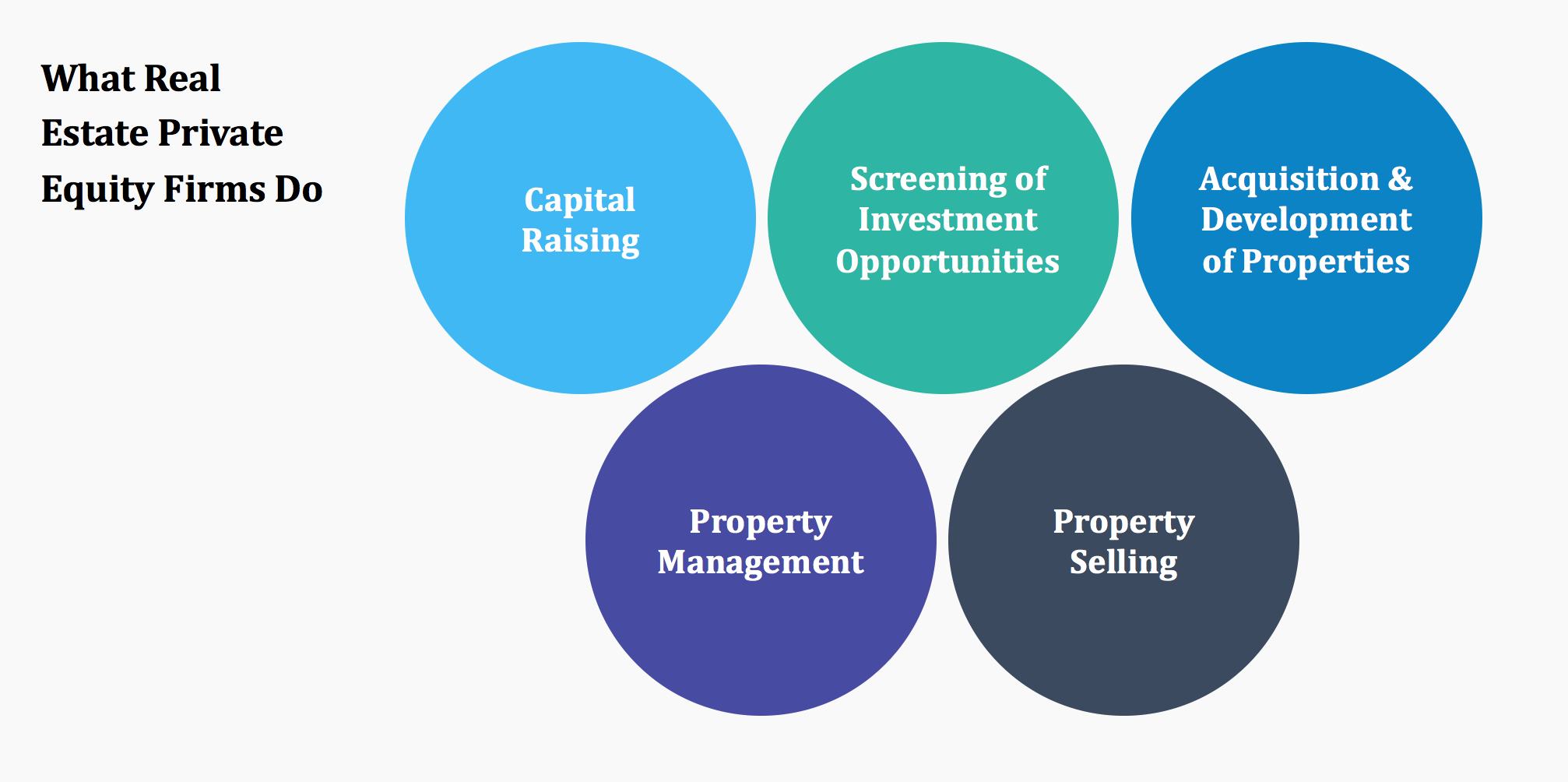

How Do Private Real Estate Firms Operate?

Private real estate firms acquire, manage, and sell properties. They focus on maximizing investor returns through strategic investments.

What Should I Consider Before Investing?

Consider the firm’s track record, management team, fees, and investment strategy. Also, assess market conditions and risk factors.

Are Private Real Estate Investments Safe?

Private real estate investments carry risks but can be safe with thorough research, due diligence, and a diversified portfolio.

Conclusion

Choosing the right real estate investment company is crucial for success. The five companies mentioned offer excellent opportunities. They provide strong returns and reliable support. Research each option thoroughly to find the best fit. Investing wisely can lead to long-term financial growth and stability.

Make informed decisions and achieve your real estate investment goals.