10 Best Real Estate Investment Trusts Real estate investment trusts (REITs) offer a way to invest in real estate without owning property. The best REITs provide solid returns and diversification.

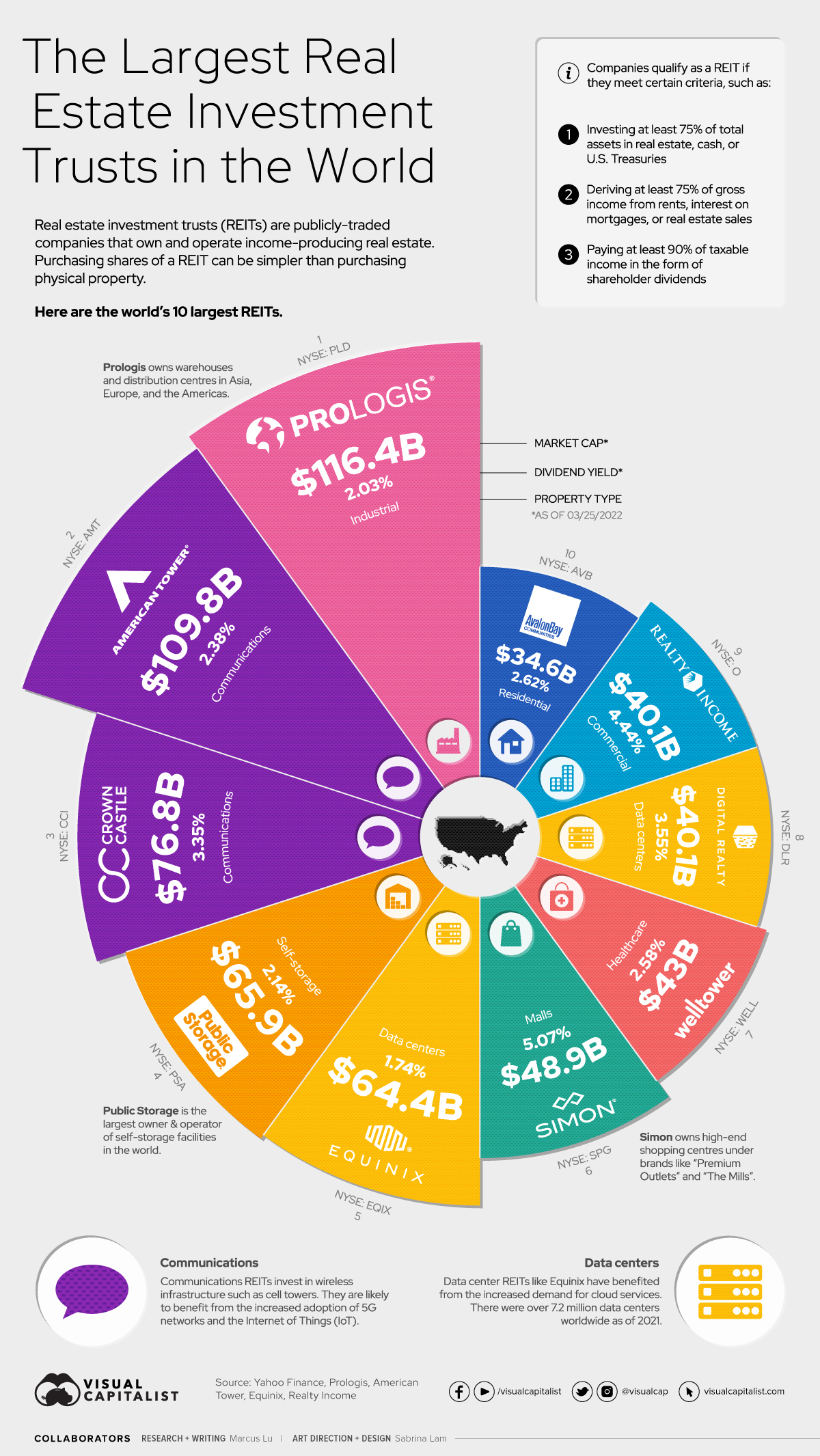

Real estate investment trusts, or REITs, are companies that own, operate, or finance real estate that produces income. They allow investors to buy shares in a portfolio of real estate assets, much like investing in a mutual fund. REITs generate income through rental income, interest on mortgages, or sales of properties.

They are required to distribute at least 90% of their taxable income to shareholders, making them an attractive option for income-focused investors. Investing in REITs offers a diversified exposure to real estate investment trusts markets without the hassle of managing properties. Here are ten of the best REITs to consider for your investment portfolio.

Introduction To Real Estate Investment Trusts

Real Estate Investment Trusts, commonly known as REITs, allow you to invest in real estate. They own, operate, or finance income-producing properties. These can include office buildings, shopping malls, apartments, hotels, and more. By investing in REITs, you can earn income from real estate without owning physical property.

Benefits Of Investing In Reits

- Diversification: REITs allow you to diversify your portfolio. You can invest in various types of properties.

- Liquidity: REITs are traded on major stock exchanges. This makes them easy to buy and sell.

- Income: Most REITs pay out dividends regularly. This provides a steady income stream.

- Accessibility: You can start investing with small amounts. This makes REITs accessible to many investors.

How Reits Work

REITs operate by pooling money from many investors. They use this money to buy and manage income-producing properties.

There are two main types of REITs:

- Equity REITs: These own and operate income-generating real estate.

- Mortgage REITs: These provide loans or purchase mortgage-backed securities.

REITs must distribute at least 90% of their taxable income to shareholders. This is why they often pay high dividends.

| Type | Description |

|---|---|

| Equity REITs | Own and manage physical properties. |

| Mortgage REITs | Finance properties by lending money. |

Credit: talkmarkets.com

Top 10 Reits For Your Portfolio

Investing in Real Estate Investment Trusts (REITs) can be a smart move. They offer steady income and diversification. Here, we will explore the top 10 REITs for your portfolio.

Diverse Portfolio Reits

These REITs have assets in various sectors, providing stability and growth potential.

| REIT Name | Sector | Market Cap (in billions) |

|---|---|---|

| Simon Property Group | Retail | $40 |

| Prologis | Industrial | $60 |

| Equinix | Data Centers | $70 |

High Yield Reits

These REITs offer high dividend yields, making them attractive for income-focused investors.

- Omega Healthcare Investors – Specializes in healthcare properties. Offers a yield of 8%.

- Annaly Capital Management – Focuses on mortgage-backed securities. Provides a yield of 10%.

- AGNC Investment Corp – Invests in residential mortgage assets. Delivers a yield of 9%.

Adding these REITs to your portfolio can help diversify your investments. They offer stable income and potential for growth.

Analyzing The Market Leaders

Understanding the best Real Estate Investment Trusts (REITs) can be a game-changer. By analyzing market leaders, you can make informed investment decisions. In this section, we focus on the key players in the REIT industry.

Performance Metrics

To assess the best REITs, we need to look at performance metrics. These include:

- Dividend Yield: The ratio of annual dividends to the share price.

- Funds From Operations (FFO): A measure of cash generated by the REIT.

- Occupancy Rates: The percentage of rented properties.

Top REITs maintain high dividend yields and robust FFO. They also have high occupancy rates.

| REIT Name | Dividend Yield | FFO (in millions) | Occupancy Rate |

|---|---|---|---|

| REIT A | 4.5% | $1,200 | 95% |

| REIT B | 4.2% | $900 | 97% |

| REIT C | 4.8% | $1,500 | 96% |

Growth Strategies

Successful REITs deploy effective growth strategies. These strategies ensure long-term success and stability. Here are some common growth strategies:

- Acquisitions: Buying more properties to increase asset base.

- Development: Building new properties to expand portfolio.

- Property Management: Enhancing property value through efficient management.

Top REITs focus on strategic acquisitions and property development. They also prioritize superior property management.

Understanding these performance metrics and growth strategies can help you identify the best REITs. This knowledge ensures you make informed investment decisions.

Credit: www.realestateskills.com

Emerging Reits To Watch

Real Estate Investment Trusts (REITs) offer unique investment opportunities. Emerging REITs are gaining traction. These trusts adopt innovative strategies, capturing market attention. Here, we explore the most promising ones.

Innovative Business Models

New REITs are adopting creative business models. They focus on niche markets and technology integration. Below are some emerging trends:

- Green Buildings: Focus on eco-friendly, energy-efficient properties.

- Data Centers: Investment in data storage and processing facilities.

- Healthcare: Properties like hospitals and senior housing.

These models attract investors seeking sustainability and growth. The focus is on future-proof assets. Investors find these niches appealing and profitable.

Market Disruptors

Emerging REITs often disrupt traditional markets. They adopt advanced technologies and unique strategies. These disruptors are reshaping the real estate landscape.

Here are some key players:

| REIT Name | Focus Area | Key Innovation |

|---|---|---|

| Prologis | Logistics and Warehousing | Smart Warehouses with IoT |

| Digital Realty | Data Centers | Green Data Storage |

| Welltower | Healthcare | Senior Care Facilities |

These REITs are not just following trends. They set new standards in the industry. Their innovations attract investors looking for cutting-edge solutions.

Strategies For Investing In Reits

Real Estate Investment Trusts (REITs) are a popular way to invest in real estate. They allow investors to earn a share of the income produced through commercial real estate ownership. Here are some strategies to consider when investing in REITs.

Long-term Vs. Short-term Investment

Long-term investments in REITs can yield significant returns. These investments benefit from property appreciation and rental income. The longer you hold, the more you earn.

Short-term investments in REITs focus on market trends. Investors buy REITs at a low price and sell when the price rises. This requires careful market analysis and timing.

| Investment Type | Benefits | Risks |

|---|---|---|

| Long-Term | Property appreciation, steady income | Market downturns, economic shifts |

| Short-Term | Quick profits, market opportunities | Market volatility, rapid changes |

Risk Management

Investing in REITs involves risks. Risk management is crucial to protect your investment.

- Diversify your portfolio. Include different types of REITs.

- Research the market. Understand the factors affecting real estate.

- Monitor economic indicators. Interest rates and inflation impact REIT performance.

Use a diversified portfolio to spread risk. This includes residential, commercial, and industrial REITs. Each type reacts differently to market changes.

Regularly review your investments. Keep track of market trends and economic indicators. This helps you make informed decisions and adjust your strategy.

Understand the impact of interest rates. High interest rates can decrease REIT returns. Low interest rates usually increase REIT values.

Credit: www.linkedin.com

The Future Of Real Estate Investment Trusts

The world of Real Estate Investment Trusts (REITs) is evolving. Investors are keen to understand what lies ahead. The future of REITs holds exciting trends and predictions. Let’s dive into these developments.

Trends To Follow

Several trends are shaping the future of REITs. Here are the top ones:

- Sustainable Investments: Green buildings are gaining popularity. Investors favor eco-friendly properties.

- Technology Integration: Smart buildings with advanced tech are in demand. These include energy-efficient systems and automated controls.

- Urbanization: More people are moving to cities. This drives demand for urban real estate.

- Hybrid Work Models: Flexible workspaces are trending. Office spaces adapt to new working habits.

- Healthcare Real Estate: Aging populations need more healthcare facilities. REITs are investing in medical properties.

Predictions And Potential

The future of REITs looks promising. Here are some predictions:

- Increased Digitalization: Real estate management will go digital. This includes virtual property tours and online transactions.

- Higher Yields: REITs may offer better returns. Diversified portfolios can reduce risks and increase profits.

- Global Expansion: REITs will explore international markets. Emerging economies offer new opportunities.

- Improved Liquidity: Trading REIT shares will become easier. Investors will benefit from quicker transactions.

- Regulatory Changes: New laws may impact REITs. Governments might offer incentives for sustainable investments.

Overall, the future of REITs is bright and full of potential. Investors should keep an eye on these trends and predictions. This can help them make informed decisions.

Frequently Asked Questions

What Is A Real Estate Investment Trust?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate.

How Do Reits Generate Income?

REITs generate income through leasing properties, collecting rent, and selling owned real estate.

Are Reits A Good Investment?

REITs can be a good investment for steady income and diversification in a portfolio.

What Types Of Properties Do Reits Own?

REITs own various property types, including commercial, residential, industrial, and healthcare properties.

How To Invest In Reits?

Invest in Real Estate Investment Trust through stock exchanges, mutual funds, or ETFs that focus on real estate.

What Are The Risks Of Investing In Reits?

Risks include market volatility, interest rate changes, and property value fluctuations.

Conclusion

Choosing the right Real Estate Investment Trust can boost your portfolio. Research each option to find the best fit. Diversifying investments can lead to stable returns. Stay informed and make educated decisions. Investing wisely in REITs can provide financial growth and security.

Happy investing!